Analysis and proof of advisability of the IOC establishment for an Oil and Gas production company assets

CUSTOMER

One of the largest vertically integrated oil companies in Russia. The company is focusing on the geological studies of subsurface resources; exploration and production; hydrocarbons supply; oil, gas, and natural gas refining products sales. The company is working in more than 30 countries.

The study was initiated by Customer as part of corporate Digital Transformation program which implies the concept of field management business processes integration based on high-performance data gathering systems and state-of-the-art analytics.

DRIVERS

The concept of an IOC as a new organisational unit on the asset level has become one of the outputs of corporate Digital Transformation program implementation. The scope of IOC functions includes a wide range of analytical tasks such as field operations planning and scheduling, engineering support and production optimisation.

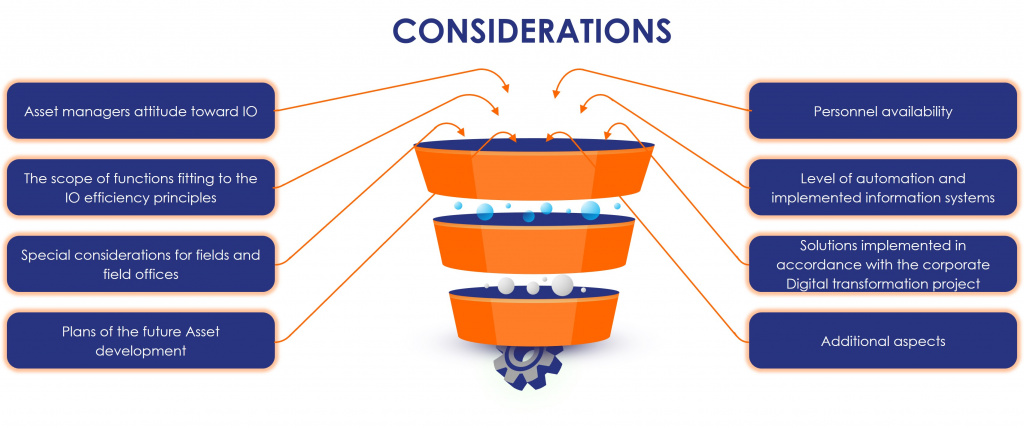

The decision to establish an IOC asset is made by considering the specific characteristics of the operated fields, the legacy of production management process practices, field development plans as well as own and international experience of implementing integrated operations principles.

Picture 1. Examples of considerations to be assessed when making a decision to establish the IOC in the asset

OBJECTIVES

To conduct an analysis and provide an assessment of the advisability of establishing an IOC for five onshore Customer’s assets producing oil and gas in different regions of West Siberia. They are all brownfield sites, each with a unique legacy, both in terms of the technological solutions applied and the culture of how they are being managed.

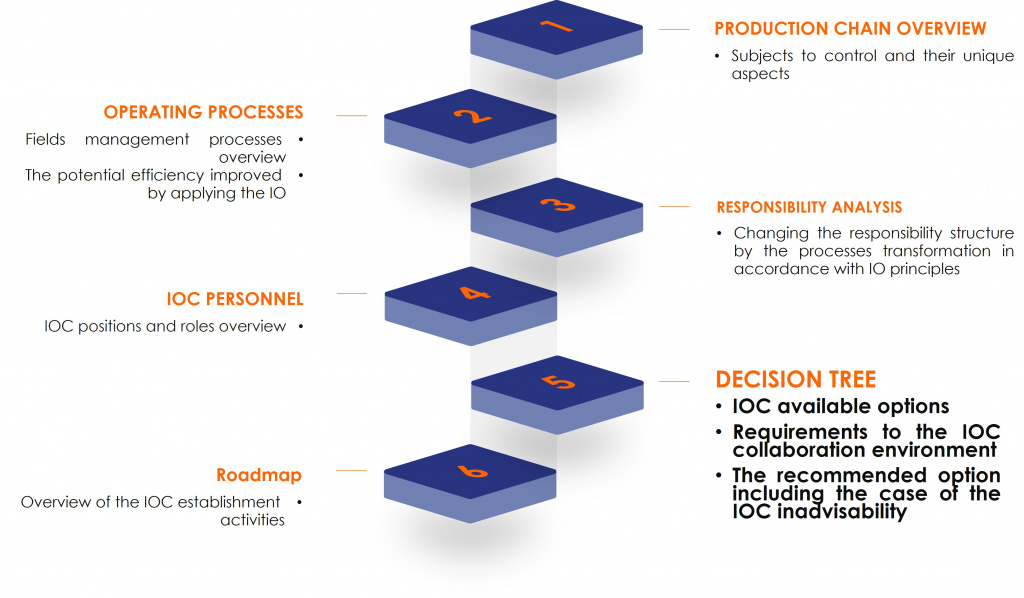

Picture 2. The expected outcome of the study

FULFILMENT

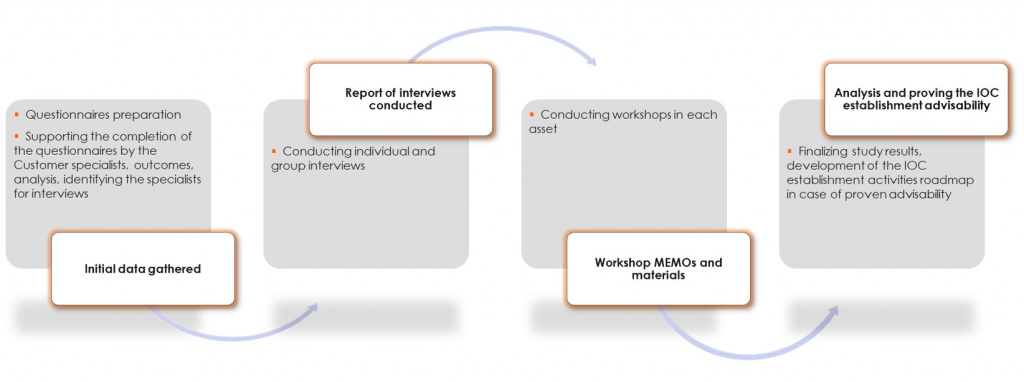

The study was performed within 4 key stages:

Picture 3. Key stages of the study

Initial data gathering and analysis were carried out during Stage 1. It included operating management system documents (145 guidelines, 196 job descriptions and department standing orders) and 20+ issue-related templates filled in by customer specialists in accordance with the instructions provided by the contractor.

The data collected was used to prepare for individual and group interviews conducted in Stage 2 with managers and key functional specialists from each of the five assets included in the study scope.

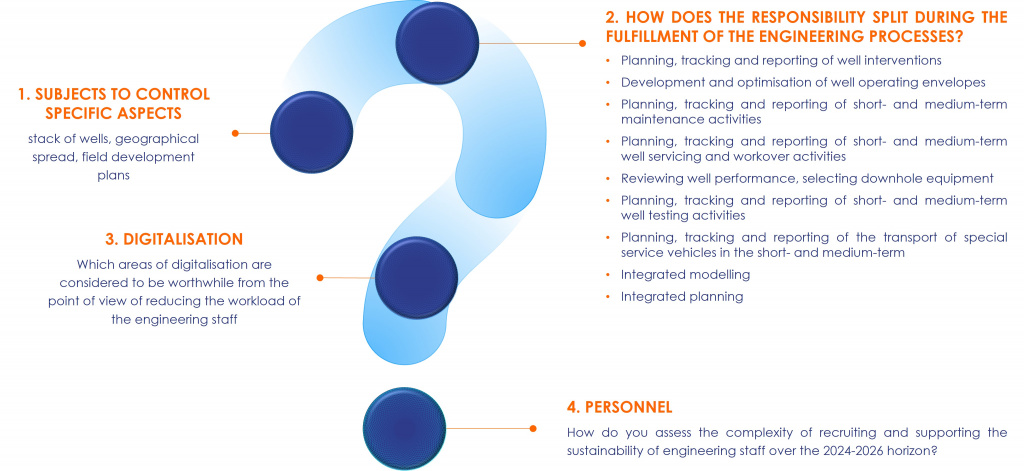

Picture 4. The structure of the questions of the individual / group interview

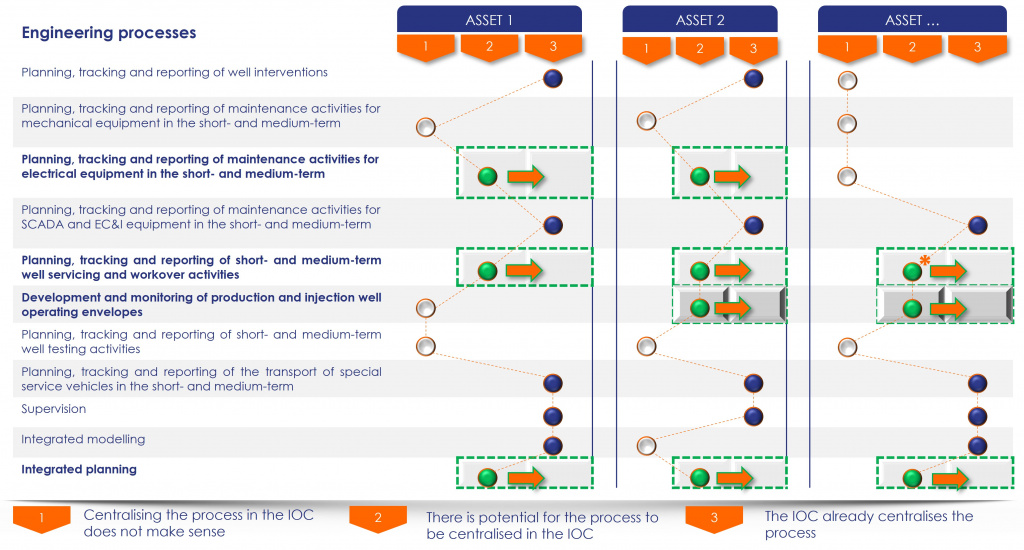

The results of the interviews made it possible to clarify the quantitative measures used to assess the advisability of establishing the IOC (operating well stock, number of field offices, geographical distribution, etc.) and to build the detailed overview of the engineering processes, identify the potential for centralising them in the IOC, and discussing the barriers to this type of centralisation. The last task was carried out in Stage 3 in the form of face-to-face workshops:

Picture 5. The potential of centralising engineering processes in the IOC

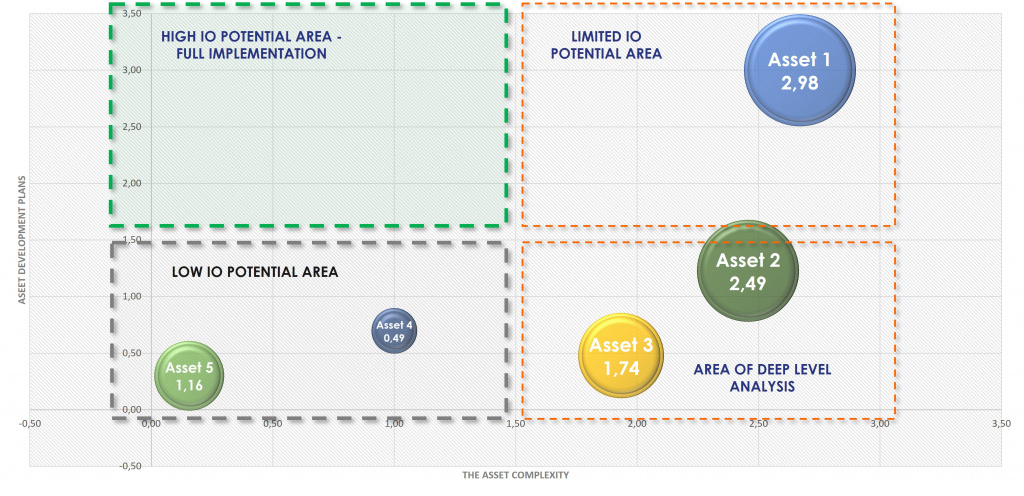

The quantitative measures collected in Stage 2 and the understanding of the potential for centralising engineering processes in the IOC gained in the Stage 3 allowed integrated indicators to be calculated to assess the IOC's advisability:

-

Asset complexity

-

Asset field development plans

-

Current IO maturity and potential

Each indicator was mathematically adjusted to range from 0 to 3 and plotted as shown below:

Picture 6. Assets mutual comparison

There are no assets in the scope with a relatively low level of complexity and ambitious plans for improvement.

Asset 1 has a high level of current IO maturity and potential (the "bubble" size) and ambitious improvement prospects. However, considering the value of complexity indicator, the transformation to Integrated Operations is recommended only for a selected set of engineering processes in order to minimise the risks to existing legacy management system.

Assets 2 and 3 are comparable to Asset 1 in terms of complexity and below it in terms of the ambitious plans for new fields involvement. However, the potential for efficiency gains is highlighted for some selected engineering processes.

Assets 4 and 5 are limited due to the specific aspects of the operated fields and have relatively low level of complexity. They are not recommended to change the existing operating model and establish the IOC.

Aforementioned recommendations were considered and accepted by Customer. The roadmaps were developed for Assets 1, 2 and 3 in order to transform engineering processes management model and establish the IOC.

The study was conducted, evaluated, and completed within a three-month period.

RESULTS

-

An in-depth analysis is conducted and a strong case for establishing an IOC for five Customer assets is represented. The analysis took into account specific aspects of the operated oil and gas fields, the legacy of production management practices, and the ambitions for further growth.

-

Three assets have the potential to gain additional value by changing the existing operating model, centralising and unifying the selected set of engineering processes in the IOC.

-

Digital initiatives heading to the enhancement of the efficiency of existing production management processes (even without changing the logic and structure of the fulfilment responsibility) are summarised and represented to Customer to make a decision.